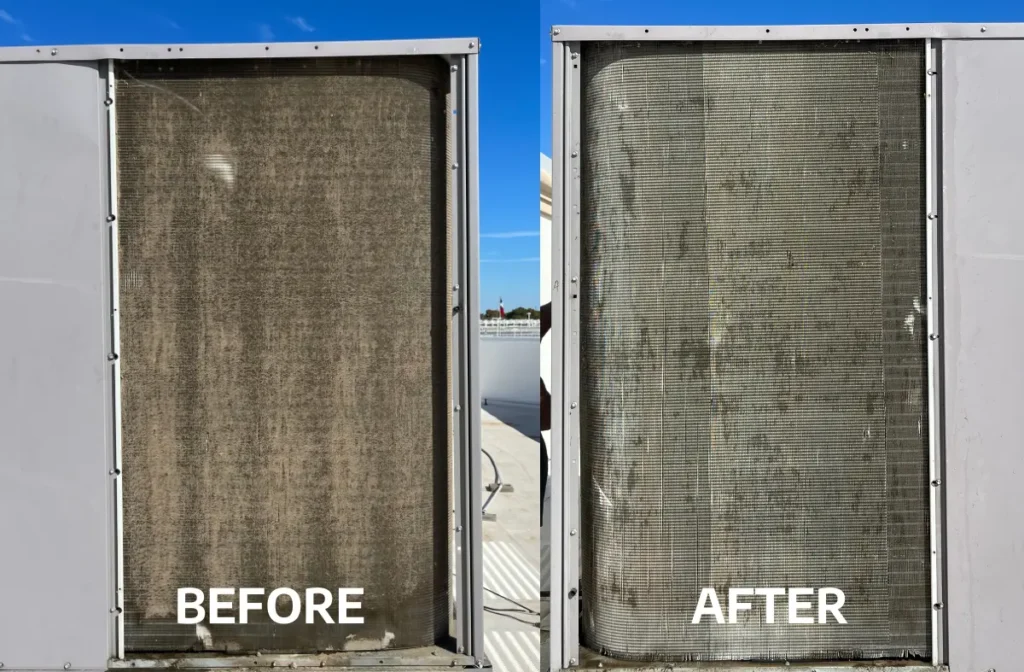

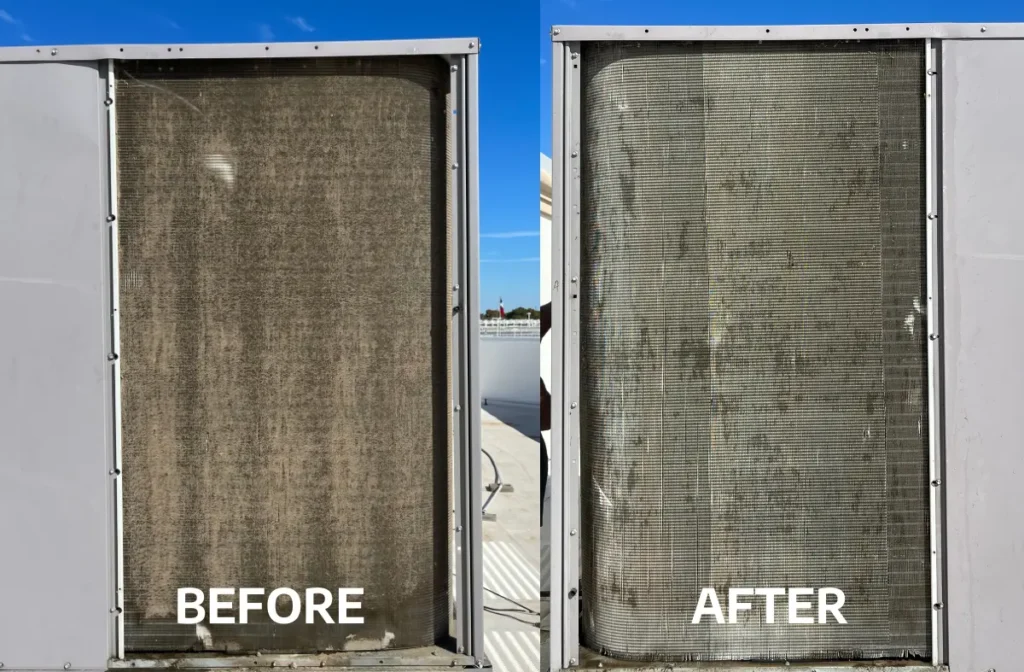

Are you hearing strange noises, noticing higher utility bills, or your HVAC unit is more than ten years old? These are all signs you may need a new HVAC system. Upgrading your home’s HVAC system can be both exciting and daunting. While the promise of enhanced comfort and energy efficiency is alluring, the financial aspect often looms large. Fear not! Keep reading to explore the ins and outs of financing HVAC systems, ensuring that your quest for indoor comfort doesn’t leave your wallet feeling the heat.

Before diving into the specifics of financing HVAC systems, let’s acknowledge why such financing might be necessary. HVAC installations can be substantial investments, and many homeowners may not have the necessary cash on hand to cover the upfront costs. Financing provides a viable option, allowing you to enjoy the benefits of a new system without straining your budget.

Before seeking financing, it’s crucial to assess your HVAC needs accurately. Consider the size of your home, local climate, and any specific requirements you might have. A thorough assessment will not only help you choose the right HVAC system but also enable you to determine the appropriate financing amount. The experts at Southern Air Mechanical will help guide you through the assessment process and discuss any questions you have regarding products, installation, and cost.

Financing HVAC systems come in various forms, and it’s essential to explore your options to find the most suitable arrangement for your situation. Here are three examples of financing options:

Upgrading your system is an investment, so you must take your time and find the correct financing option for you and your budget.

Your credit score will play a crucial role in determining your financing terms. A higher credit score typically means lower interest rates and more favorable repayment terms. It’s advisable to check your credit score before applying for financing and take steps to improve it if needed.

Once you’ve secured financing for your new HVAC system, it’s vital to incorporate the repayments into your budget. Understand the terms of your financing agreement, including interest rates, monthly payments, and any potential penalties for early repayment. Integrating these costs into your budget ensures a smooth and stress-free repayment process.

Financing your new HVAC system doesn’t have to be a daunting task. You can confidently embark on this home improvement journey by assessing your needs, exploring various financing options, considering your credit, and budgeting wisely. Remember, achieving indoor comfort should enhance your life, not burden your finances.

Stay cool, contact Southern Air Mechanical to upgrade your HVAC system, and find an HVAC financing journey that’s as breezy as the air it provides!

(817)447-8247

info@southern-air.net

Open 24 hours

Mon - Fri: 7am to 4pm